Quantifying Automation Payback in Government Administration

Automation and artificial intelligence (AI) are transforming government operations by delivering faster citizen services, reducing backlogs, and increasing transparency. Yet, one of the biggest challenges for public agencies is quantifying the value — the ROI — of their AI and automation projects. This article guides both program managers starting with their first automation pilot and state CIOs tasked with scaling automation across agencies. You’ll find actionable strategies for realizing government AI ROI, capturing public sector automation value, and building a comprehensive state CIO AI dashboard to inform and engage stakeholders.

Article 1 – Building the Business Case for Your First AI Bot

For Agency Program Managers Starting Out

Selecting the Right Processes to Automate

If you’re a program manager in government administration, the best way to start your automation journey is small, focusing on citizen-service processes that have high transaction volumes and repetitive workflows. Good starter candidates include:

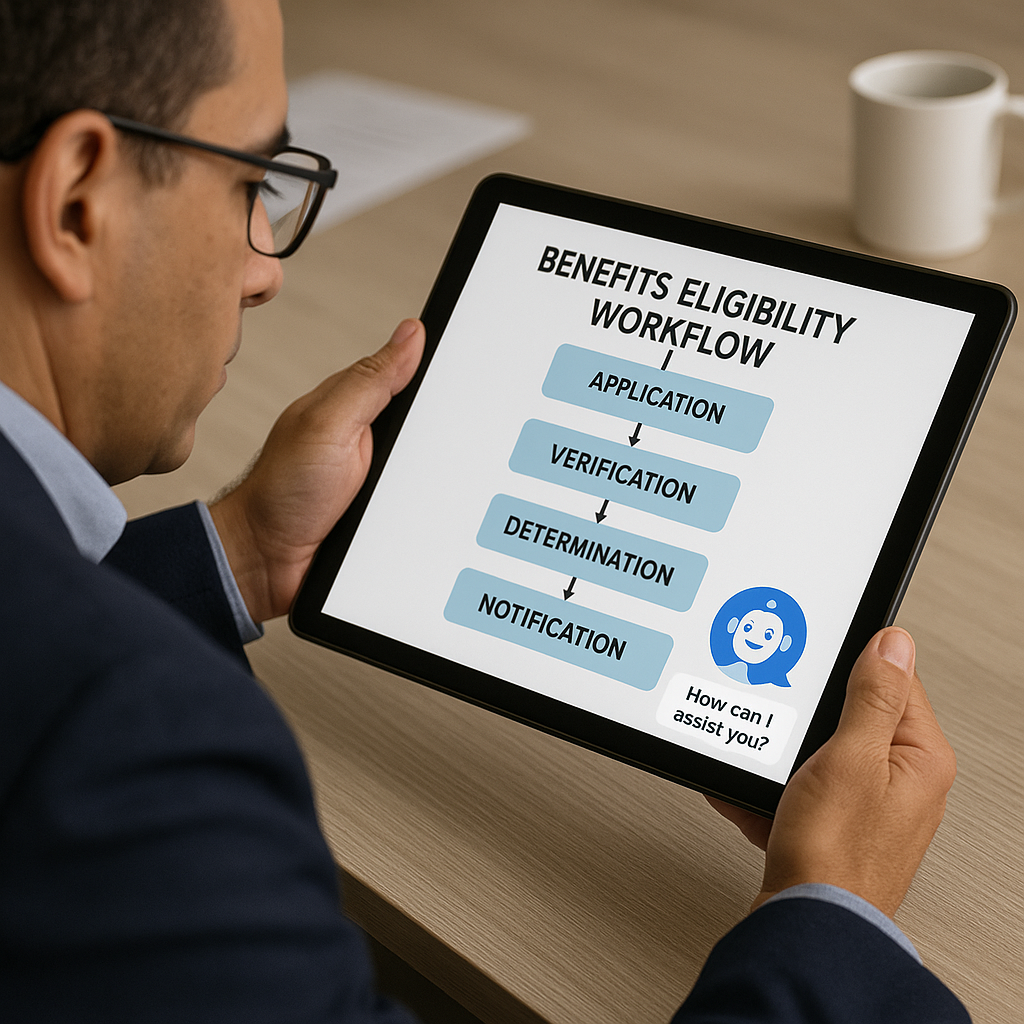

- Benefits eligibility screening: Verifying documents and eligibility criteria for programs like unemployment, healthcare, or housing.

- Permit requests: Processing standard applications for business, construction, or event permits.

These processes offer high impact for both efficiency and citizen satisfaction.

Quantifying Cost Per Transaction: The First Step to ROI

Measuring the cost per transaction before and after AI automation is essential to establish your government AI ROI. For example, if a benefits eligibility application costs $10 per review and automation can reduce this to $5, that’s an immediate, measurable value. Calculate annual savings by multiplying the per-transaction difference by the number of transactions.

ROI Beyond Dollars: Service Levels and Accessibility

While financial savings are important, ROI in the public sector should also be framed in terms of broader value:

- Wait-time reduction: Automation can slash response times from days to hours, greatly improving citizen experience.

- Accessibility improvements: AI can offer multichannel access (web, phone, chatbot), making services more inclusive.

Highlight these non-monetary benefits alongside cost savings to create a robust automation business case.

Funding Your First Automation Initiative

Agencies can leverage several funding models:

- Innovation labs: Many governments have in-house innovation or digital transformation teams that provide seed funding for pilots.

- Federal grants: Look for grant programs targeting digital government, AI, or process improvement.

Early alignment with finance teams ensures funding pathways are clear and helps avoid delays later on.

Engaging Stakeholders: Unions and Oversight

Successful automation requires transparent communication with all stakeholders:

- Unions: Address job-impact concerns. Emphasize AI’s role in reducing repetitive tasks, not replacing workers, and highlight upskilling initiatives.

- Oversight committees: Prepare clear documentation and engage early. Provide quarterly ROI metrics and updates on citizen service improvements for accountability.

By thoughtfully managing stakeholders, program managers can drive support and keep automation initiatives moving smoothly.

Article 2 – State-Wide ROI Dashboard for AI Programs

For State Government CIOs Scaling AI

Aggregating ROI Across Agencies

As AI automation expands, state CIOs need a standardized way to measure and communicate overall public sector automation value. This begins by aggregating ROI from individual agency pilots using a central platform or dashboard.

Standardizing KPIs for Meaningful Comparisons

Set standard KPIs that every department must report:

- Per-transaction cost savings

- Service wait-time reductions

- Citizen satisfaction scores

- Accessibility metrics

By keeping metrics consistent, the dashboard enables apples-to-apples comparisons and informs both internal decisions and legislative reporting.

Cost-Avoidance vs Revenue-Recovery Tracking

Not all automation savings show up as direct cost reductions. Track both:

- Cost-avoidance: Automating backlogs prevents future hiring or overtime costs.

- Revenue-recovery: AI in fraud detection or tax processing recoups funds that may otherwise be lost.

Separately reporting these helps policy makers understand the full spectrum of AI benefits.

Enhancing Accountability with Open Data Portals

Transparency is crucial in government automation. Consider publishing elements of your state CIO AI dashboard to the public — for example, via open data portals. Sharing anonymized, aggregate ROI and service-improvement data not only builds public trust but also meets legislative mandates for accountability.

Including Sustainability and Equity Metrics

Public sector automation value increasingly includes environmental and social impacts:

- Paper reduction: Digital workflows dramatically lower paper usage, supporting sustainability goals.

- Energy savings: AI can optimize data center operations, reducing government energy footprints.

- Service equity: Ensure your dashboard highlights usage and service-level improvements among underserved communities.

Incorporating these into your dashboard keeps your automation program aligned with modern public values and priorities.

Conclusion: Building Lasting Value from AI in Government

The journey to meaningful government AI ROI starts with quantifiable, citizen-facing wins at the program manager level. It scales by leveraging enterprise platforms, standard KPIs, and transparent reporting — best practices that empower CIOs to demonstrate public sector automation value. By tracking and communicating outcomes via a central state CIO AI dashboard, state governments can ensure AI investments deliver on their promise: more effective, inclusive, and sustainable public service for all citizens.

If you’re looking to start or scale AI in your government agency, focus first on clear measurement, stakeholder alignment, and transparent communication. The benefits — for both taxpayers and public servants — make the investment worthwhile.

Have questions or want to discuss automation strategies for your agency? Contact us.

In the era of energy AI data initiatives, utility operators stand at the critical intersection of legacy SCADA infrastructure and next-generation digital transformation. For Operations Managers tasked with launching predictive AI pilots, the road begins with a familiar-yet-daunting challenge: SCADA data cleansing and preparing grid sensor streams for accurate machine learning outcomes. Let’s break down the tactical steps to move from noisy, heterogeneous sensor feeds to clean datasets ready for advanced AI applications.

In the era of energy AI data initiatives, utility operators stand at the critical intersection of legacy SCADA infrastructure and next-generation digital transformation. For Operations Managers tasked with launching predictive AI pilots, the road begins with a familiar-yet-daunting challenge: SCADA data cleansing and preparing grid sensor streams for accurate machine learning outcomes. Let’s break down the tactical steps to move from noisy, heterogeneous sensor feeds to clean datasets ready for advanced AI applications. Do you process raw signals right at the substation edge or centralize all cleansing in a data center? The answer is a smart combination of both:

Do you process raw signals right at the substation edge or centralize all cleansing in a data center? The answer is a smart combination of both: